Auto Insurance in and around Ann Arbor

Take this great auto insurance for a spin, Ann Arbor

Let’s get this coverage on the road

Would you like to create a personalized auto quote?

Your Auto Insurance Search Is Over

Why choose Dana Rowry as your State Farm auto insurance representative? You want an agent who is not only knowledgable in the field, but is also your personal associate. With State Farm, Ann Arbor drivers can enjoy an insurance policy aligned with their individual needs, all backed by a top provider of auto insurance.

Take this great auto insurance for a spin, Ann Arbor

Let’s get this coverage on the road

Your Quest For Auto Insurance Is Over

State Farm offers flexible reliable coverage with a variety of savings options available. You could sign up for Drive Safe & Save™ for savings up to 30%. Then there's the Steer Clear and Good Student Discounts that offer savings until you turn 25. And Vehicle Safety Features applies if your vehicle has an alarm or some other anti-theft device to deter crime. These are an example of the savings options State Farm offers! Most State Farm customers are eligible for one or more savings option. Dana Rowry can identify which ones you qualify for to make a policy for your specific needs.

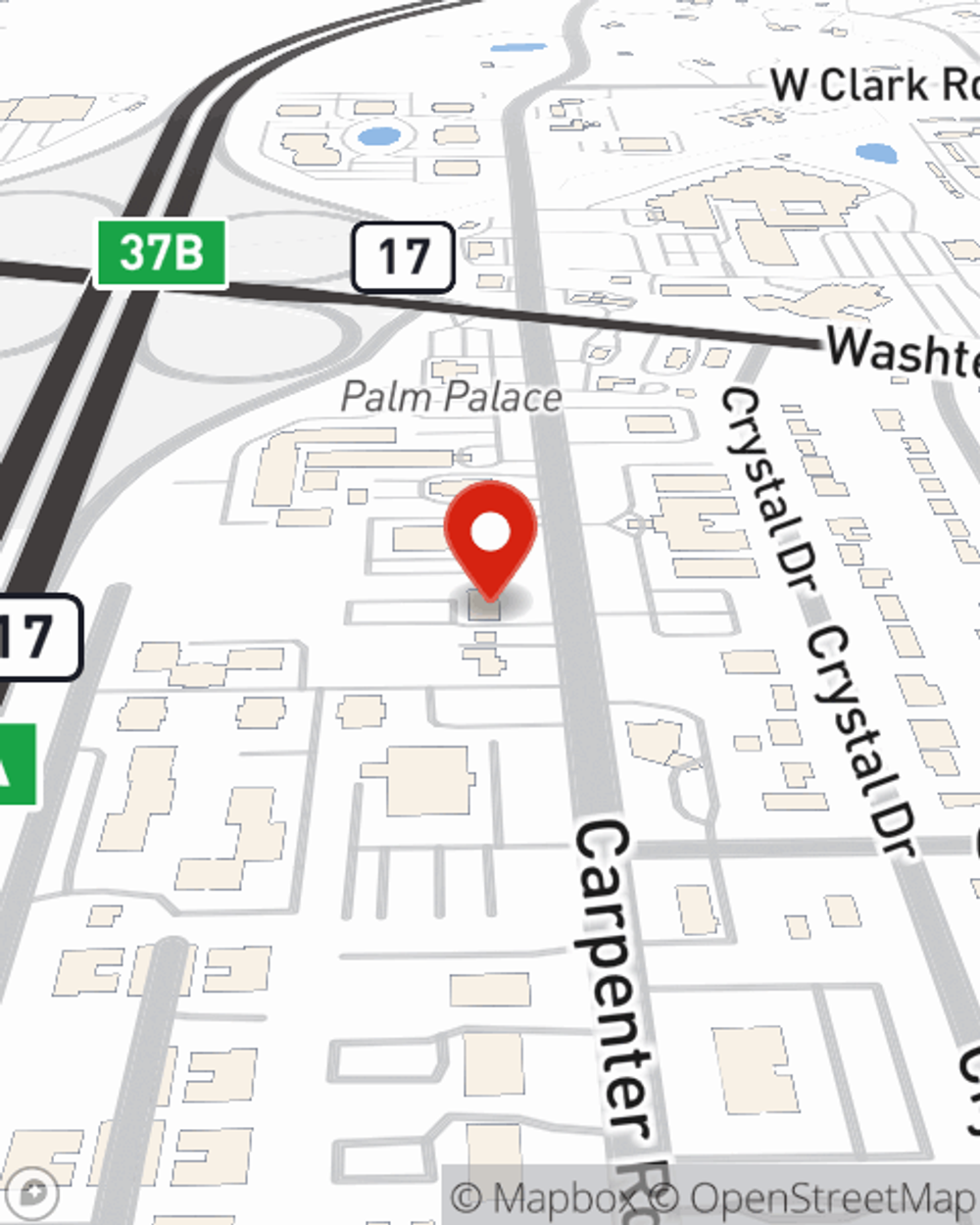

Contact State Farm Agent Dana Rowry today to see how the insurer of over 44 million auto policies in the United States can meet your auto needs here in Ann Arbor, MI.

Have More Questions About Auto Insurance?

Call Dana at (734) 973-7270 or visit our FAQ page.

Simple Insights®

Medical Payments vs liability coverage: What’s the difference?

Medical Payments vs liability coverage: What’s the difference?

What's the difference between Med Pay and liability auto insurance? Learn who's covered, when they pay and which is required vs. optional.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.

Simple Insights®

Medical Payments vs liability coverage: What’s the difference?

Medical Payments vs liability coverage: What’s the difference?

What's the difference between Med Pay and liability auto insurance? Learn who's covered, when they pay and which is required vs. optional.

When potholes become costly

When potholes become costly

A close encounter with a pothole can lead to wrecked tires, wheels and suspension components, but there are steps you can take to lessen damage.